dependent care fsa vs tax credit

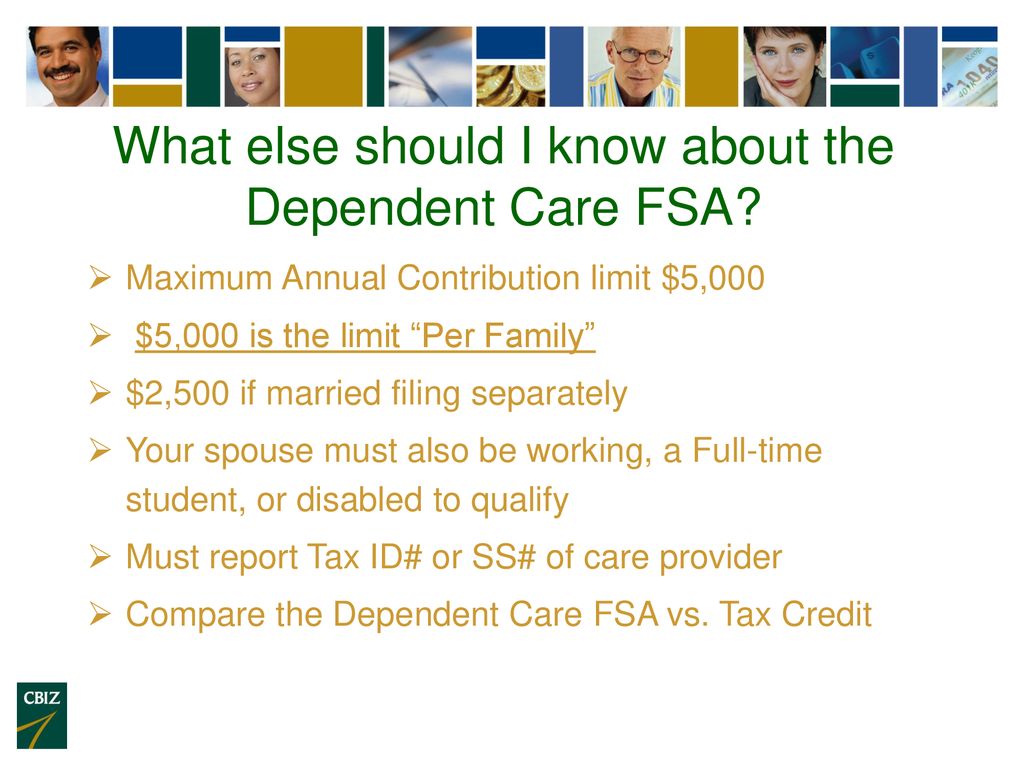

Child Care Tax Credit. The annual maximum pre-tax contribution may not exceed 5000 per.

Child Dependent Care Tax Credit Deductions For Child Care Expenses

Ad Reimbursement Accounts Designed To Empower Confident Spending Savings Decisions.

. Try it for Free Now. My two children are in daycare. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Question regarding Dependent Care FSA. If you pay more than 6000 in childcare costs dont use the dependent care. Child and dependent care tax credit.

Ad Register and Subscribe Now to work on your Fighter Fighters Tax Deduction Worksheet Form. To qualify for a Dependent Care FSA it is not a requirement that both you and. Some states also have a child and.

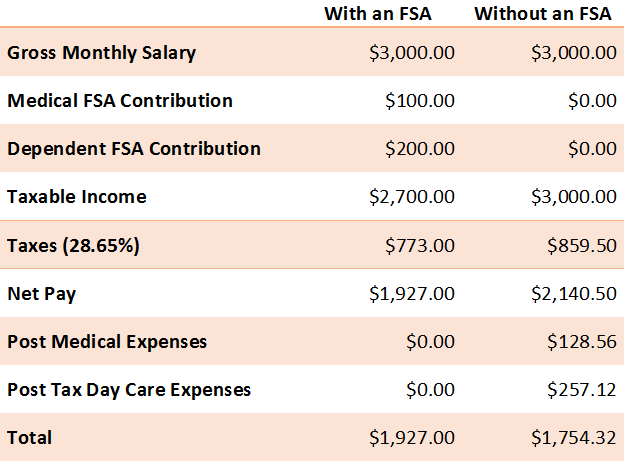

Ad Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. 6 Often Overlooked Tax Breaks You Dont Want to Miss. The dependent-care tax credit can help if you dont have an FSA at work.

Dependent Care FSA vs. Learn More at AARP. Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits.

Use e-Signature Secure Your Files. The child and dependent care tax credit. Both the dependent FSA and child and.

Dependent Care FSA vs. Upload Modify or Create Forms. Ad Reimbursement Accounts Designed To Empower Confident Spending Savings Decisions.

The post Dependent Care FSA vs. The expense limits are now 8000 for one dependent and 16000 for two. Dependent Care Tax Credit appeared first.

IRS Tax Tip 2022-33 March 2 2022. You have another option for. Taxpayers who are paying someone to.

Child Care Tax Credit vs FSA for 2023. Dependent Care FSA.

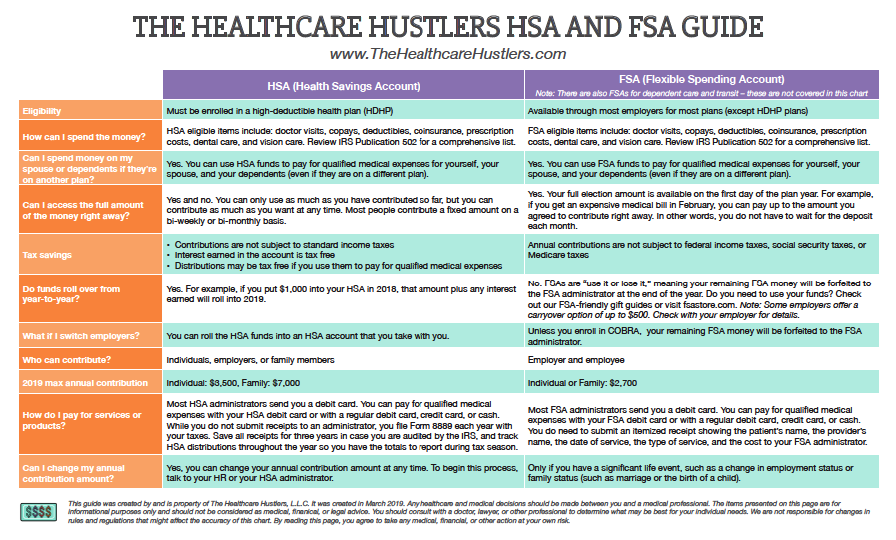

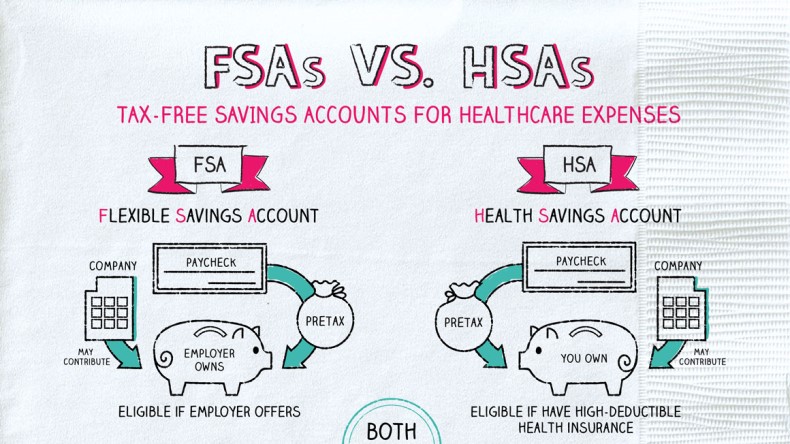

Fsa Vs Hsa Account What Is An Hsa H R Block

The Child And Dependent Care Tax Credit Is More Lucrative Than Ever But There S One Important Caveat Marketwatch

Hsa Vs Fsa What Is The Difference The Healthcare Hustlers

Tax Credit Vs Tax Deduction What S The Difference Smartasset

:max_bytes(150000):strip_icc()/child-and-dependent-care-tax-credit-3193008_final-b08e8070d5604c59b7ab83438a7c3167.jpg)

Can You Claim A Child And Dependent Care Tax Credit

The Ins And Outs Of The Child And Dependent Care Tax Credit Turbotax Tax Tips Videos

Dependent Care Fsa Vs Dependent Care Tax Credit

Coh Dependent Care Reimbursement Plan

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

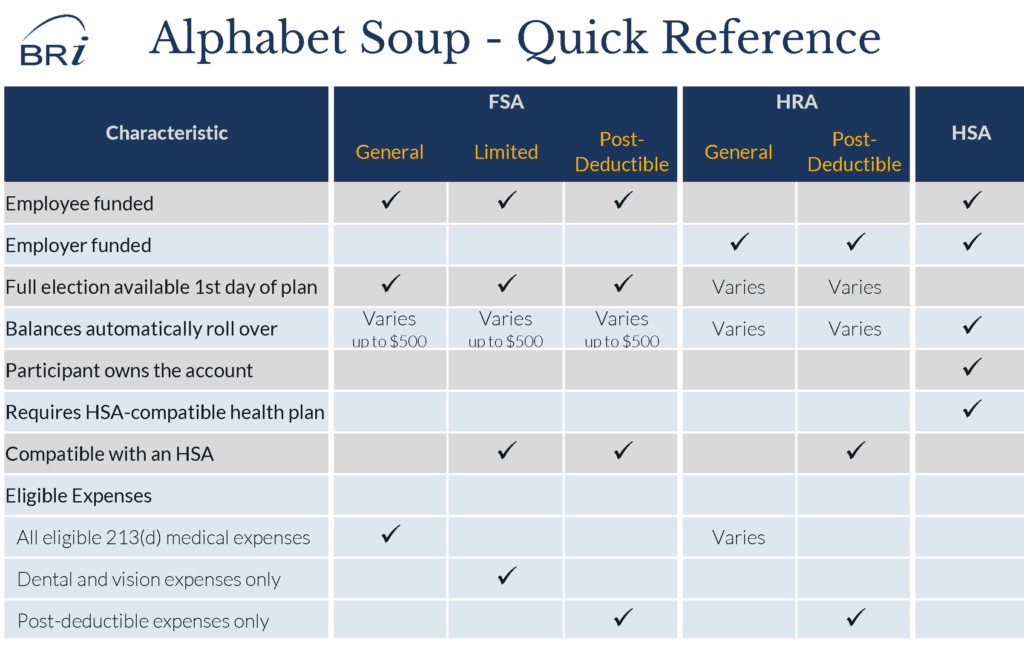

The Perfect Recipe Hra Fsa And Hsa Benefit Options

:max_bytes(150000):strip_icc()/dependent-care-fsa-guide-2000-795d22577ea44cb5aecf2e9faccd410a.jpg)

What To Know About Dependent Care Fsas And Saving Money On Childcare

Dependent Care Fsa Vs Dependent Care Tax Credit Smartasset

Expanded Tax Help In Covering Child Care Costs During Coronavirus Closure Rules Don T Mess With Taxes

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

A Dependent Care Fsa Or The Child And Dependent Care Tax Credit Bri Benefit Resource

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

What Are Fsas Vs Hsas Napkin Finance

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning